When buying a used car, one of the buyer’s risks is that the seller does not tell the truth about whether the car has a bank loan or a mortgage at a finance company.

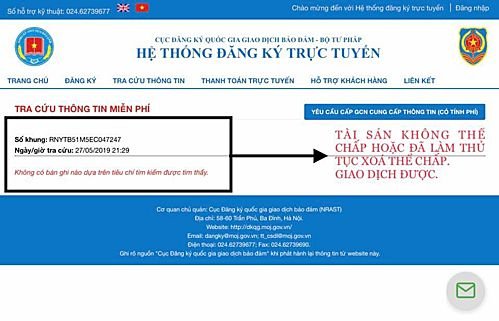

Step one: visit website https://dktructuyen.moj.gov.vn

Step two: Select `Look up information`.

Search window.

Often the buyer may not have information about the application number or guarantor.

Step three: If you don’t see the information or display `Assets are not mortgaged or mortgage removal procedures have been completed`, this means the car is `clean` and has nothing to do with the bank.

Assets that are not mortgaged or have mortgage removal procedures.

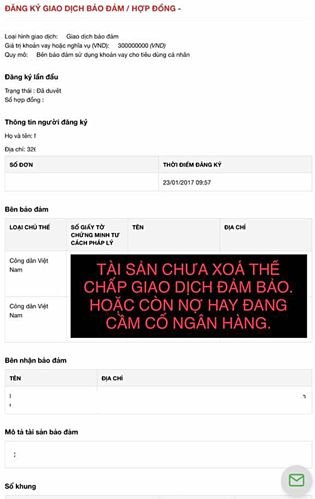

Step four: If you see the full information of the property appearing as below, showing a loan of more than 900 million VND, buyers should pay attention.

Vehicle information is signed for a guaranteed transaction at the bank.

The buyer must request the seller to contact the bank or complete the procedure to `remove the mortgage of collateral` to be able to transact (withdrawal of documents, transfer of name, mortgage).

Step five: Carefully check the information displayed on the website.

In addition to the first information displayed that there is a bank loan, the buyer should check the information below to see if it matches the information provided by the seller.

Information about assets that have not yet been mortgaged for secured transactions or are still in debt or mortgaged to banks.

Above are the steps to check if a used car is mortgaged by a bank or not that buyers need to know.

For those who buy a new car by installment loan, the bank will give you many documents to sign and then take that set of documents to register as collateral.

When you have paid off all your debt in installments or no longer use your car as collateral for a certain loan, the bank needs to guide you through the mortgage release procedure (mortgage release).