As Europe prepares to end Russian oil imports by the end of the year, US Treasury Secretary Janet Yellen is undertaking a difficult task to keep energy supplies uninterrupted.

As planned, at a meeting of G20 finance ministers in Indonesia this week, Ms. Yellen will try to convince the world’s largest economies to support an unusual proposal to impose a price ceiling on Russian oil.

A drilling rig at the Yarakta oil field in the Irkutsk region, Russia, in 2019. Photo: Reuters.

Four months after Russia launched a special military campaign in Ukraine, soaring energy prices have softened the impact of a series of Western sanctions targeting the country.

Therefore, Europe has decided to apply new restrictions at the end of this year, banning all Russian oil imports by sea.

This fear prompted the US to develop a new tactic, allowing sanctions exemption for importers who agree to buy Russian oil at the ceiling price imposed by the West at 40-60 USD/barrel, lower than

`What we want is to maintain the flow of Russian oil into the global market to stabilize prices and try to avoid a shock that could potentially cause a global recession,` the US Treasury Secretary told reporters.

The proposal to cap Russian oil prices has attracted a lot of interest in recent weeks, as G7 leaders agreed to learn more about it after a summit in Germany in late June.

Ms. Yellen said on July 13 that she discussed the idea of imposing a ceiling on Russian oil prices with Chinese Vice Premier Liu He in an online meeting last week.

China has not responded to the above information.

Ms. Yellen’s campaign efforts to cap Russian oil prices are boosted as US President Joe Biden travels to the Middle East this week, where he plans to persuade Saudi Arabia and other OPEC countries to increase oil production.

However, US officials admit that strangling Russia’s revenue by imposing a ceiling on oil prices is a long-term goal that is difficult to achieve overnight.

Pushing the idea of capping Russian oil prices is seen as an important diplomatic test for Ms. Yellen, who is making her first trip to Asia as US Treasury Secretary.

If successful, her tactics could help reduce the impact of the conflict in Ukraine on global energy prices, while significantly reducing Moscow’s oil revenues.

However, some economists and energy experts are skeptical about the effectiveness of the proposal, wondering how Western jurisdictions could enforce the Russian oil price cap and

US Treasury Secretary Janet Yellen testified before the Senate Finance Committee in June. Photo: Reuters.

According to the idea proposed by the US, if importers buy Russian oil at prices higher than the imposed ceiling price, they will face restrictions on shipping-related services such as financing and insurance.

However, the international market, which processes millions of barrels of oil to dozens of countries every day, is so large that it is beyond the capacity of some governments to handle, said a senior energy analyst from the bank.

`In reality, this idea is not feasible,` he said.

On the other hand, with attractive discount prices, China and India are increasing their purchases of Russian oil and they never want this flow to be stopped, said Andy Lipow, leader of oil market consulting company Lipow Oil.

`How do we implement it? We need China and India to agree to that idea,` Lipow said.

He added that Russia could completely avoid the price cap by requiring a tax or fee on oil exports to be paid separately.

Another question is whether Russian oil importers that do not comply with Western price ceilings will be able to buy marine insurance elsewhere to keep their tankers operating.

According to Robin Brooks, chief economist at the Institute of International Finance, based in Washington, USA, there are signs that insurance activities are starting to expand, but those efforts are in their early stages.

Brooks said that imposing a price ceiling on Russian oil could work, but it needs to be done `as soon as possible`.

Another major geopolitical risk to the US proposal is whether and how Russia will respond.

Speaking on television last week, President Vladimir Putin warned of `catastrophic consequences` for the global energy market if the West imposes more sanctions on Russia.

Gerard DiPippo, senior expert at the Center for Strategic and International Studies (CSIS), said that with Russia exporting 3.9 million barrels of crude oil per day by sea, cutting this amount by only 25% would be enough.

President Putin is also someone who is always willing to take risks, DiPippo noted.

Analysts at JPMorgan Chase estimate that in a worst-case scenario, Russia could cut 5 million barrels of crude per day without hurting the economy.

Brooks and other experts do not believe in the possibility of President Putin stopping all oil exports in response to the West.

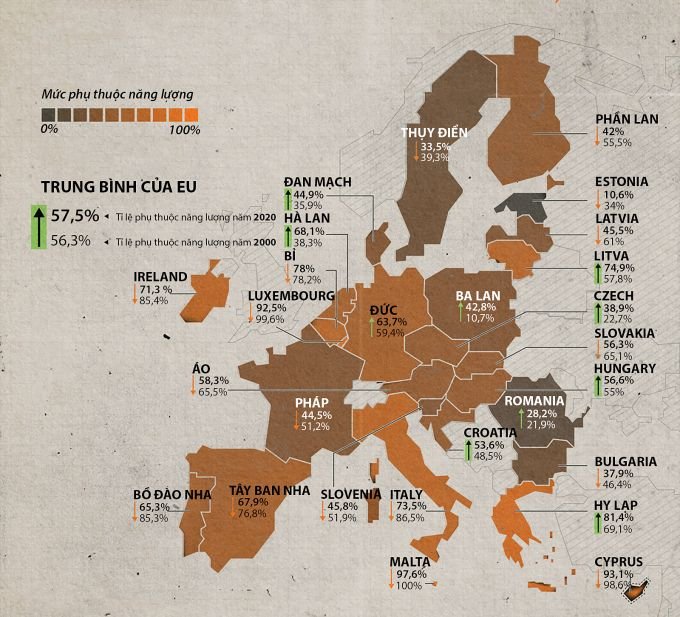

Level of EU energy import dependence.

Overall, according to Brooks, even if a complete embargo of Russian oil were implemented, it would likely be short-lived and the impact uncertain.

`What we are debating is how much pain the West can endure and for how long,` he said.